High Risk

|

Low Risk

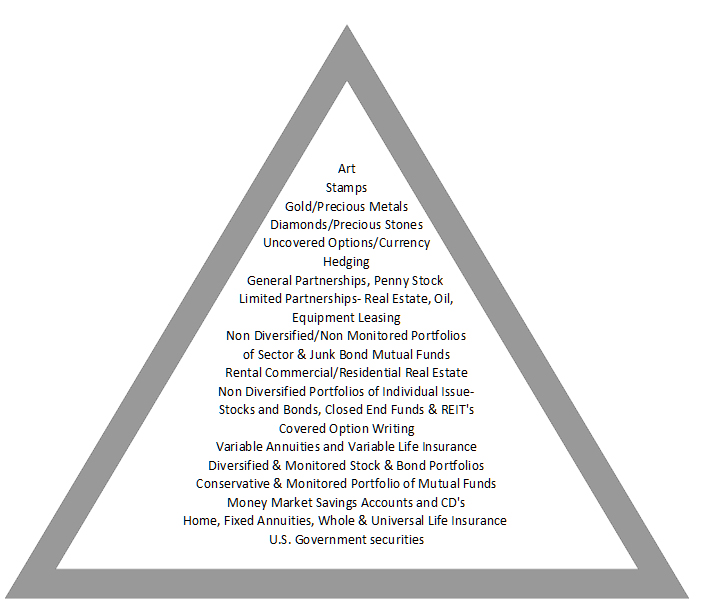

Investment Pyramid

The above is a simple chart of Investment categories by risk and reward. It is in the shape of a pyramid. With Investments at the top of the pyramid an individual can expect the greatest returns but because of the risk associated with these investments an individual can also experience the greatest risk of loss. Volatility is the key. If you knew exactly when to invest in high risk areas and exactly when to sell, then you should experience the highest returns. Consequently, with the investments at the bottom of the pyramid you would expect low returns with little risk of loss of investment. The placement of investment vehicles on the pyramid is subjective and opinions as to their placement could vary.

Overview:

More aggressive portfolios (more stock) are usually recommended for those younger and/or single while more conservative (more bond) investments are generally recommended for retirees. This is not cast in stone and depends on many variables. Before you invest at any level you should first address a budget and your current and future needs.

The essence of this exercise is to emphasize the basic risk/reward parameters. You should not invest in the more risky ventures until/unless you have covered the less risky areas first. It should be clear, therefore, that one does not utilize gold, precious metals, uncovered option writing or the use of single issue securities until the more conservative issues have been addressed- such as having enough insurance for your family.

Fixed Annuities, Whole or Universal life insurance

These policies earn income on a tax deferred basis (possibly tax free with insurance policy loans) and are essentially risk free as regards to the guarantee which is based on claims paying ability of Insurer.

Mutual Funds

By definition, mutual funds are diversified (at least 13 stocks).

Diversified Individual stock and bond portfolios

The use of individual stocks and bonds is more risky if one attempts to do it themselves. These portfolios MUST be actively monitored.

Variable Annuities

Variable annuities are annuity contracts that shift investment risk to the contract holder. The contract owner can select from among a number of separate investment accounts. Variable products are subject to mortality and expense charges and administrative fees not typically found with other investments.

Variable Life Insurance

Variable life insurance is a life insurance policy that has fixed premiums and a minimum guaranteed death benefit. Investment risk is shifted to the policy owner. The policy owner is able to direct funds backing the policy into one or more of a group of segregated investment accounts made available by the life insurance company. Variable products are subject to mortality and expense charges and administrative fees not typically found with other investments.

Covered Option Writing

Security options - puts and calls - are negotiable instruments issued in bearer form that allow the holder to buy or sell a specified amount of a specified security at a specified price within a certain time period. The buyers of puts and calls are willing to invest their capital in return for the right to participate in the future performance of the underlying security, and to do so at low unit cost and limited exposure, however, it is possible to lose one's investment in options in a relatively short period of time. Some conservative investors use options with the objective to increase their income on shares they purchased. It is important to note that options are not suitable for all investors. There is limited upside potential when writing a covered call. For example, if the underlying security's price rises above the exercise price, the buyer will typically exercise the option and the writer will be forced to sell the underlying security.

Non diversified portfolios of stock or bonds

These generate a significant amount of unsystematic risk since the movement of a single stock can seriously erode the entire holdings.

Rental real estate

Singular ownership of real estate has provided many past investors substantial returns. However, investors must recognize the personal management involved in running such operations. Real estate is a non liquid asset and should be held for a long term for investors to achieve their investment goals, even then, there is no guarantee of a profit.

Closed End funds

These are similar to open ended managed mutual funds but are issued with a fixed capitalization. They are bought in the same method as stock. They tend to be sold at a discount to Net Asset Value. Unless their track history is considered, many investors could purchase these funds with incomplete knowledge and could suffer a substantial loss.

Sector mutual funds

These must have at least 25% of their portfolios invested in a particular area- health, communications, etc. And when too much is placed in a risk area, it usually is not ultimately beneficial to the investor who does not understand the risk.

Limited Partnerships

Prior to the tax law change of 1986, many partnerships did very well. The purchase of LIMITED amounts of partnerships was generally considered acceptable for middle income wage earners. However, with the recessionary economy many went into default. Some partnerships do continue to work and are even viable today, but the risk limits their use.

General partnerships, precious metals, etc.

These require a sophistication far in excess of the normal middle income wage earner. Far too much risk and far too much to go wrong. Individuals using such investments must have considerable wealth and a thorough understanding of risk, or be advised by a knowledgeable adviser. Investing in these areas could result in substantial loss.

There can be no guarantee that any particular yield or return will be achieved from any investment. Please note that volatility including fluctuation prices and the uncertainty of rates of return inherent in investing in stocks and bonds over extended periods of time will affect the actual return received. Past performance is not indicative of future results.

© Copyright